RPA is an old concept; however, it should evolve with the times.

Robotic process automation (RPA) is a form of business process automation to define a set of instructions for a piece of software “bot” to perform. The term can be traced back to the 1990s. The initial RPA, let’s call it “RPA 1.0”, was designed to replace the time-consuming and mind-numbing repetitive human tasks, such as data entry or software testing. Helping business to move the data across different applications using functions such as desktop macros and screen-scrapping was the main objective of implementing RPA 1.0. It mimicked human-computer interactions. With relatively simple rule-based workflow, RPA 1.0 helped to automize standardized, repetitive but high-volume tasks. Most of the prevalent RPA platforms/tools yet stay at implementing RPA 1.0. In order to be able to use such RPA 1.0 Platform/tool, a business process needs to:

- Be rule-based.

- Be repeated at regular intervals or have a pre-defined trigger.

- Have pre-defined inputs and outputs.

- Have sufficient volume.

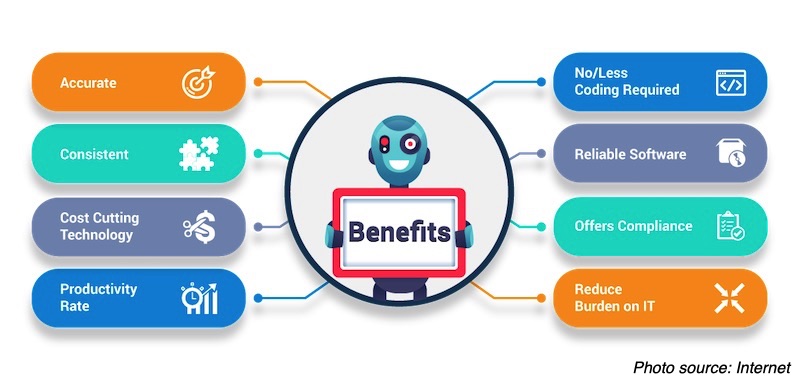

Implementing RPA 1.0 is considered a first step in the automation journey. RPA 1.0 certainly had many benefits and helped to improve business efficiency, but its value was limited.

Over the past decade, the robotics revolution has rapidly accelerated, as fast-paced technological advances in engineering, artificial intelligence, and machine learning converge. So should RPA.

Next-level RPA should be able to “see”, “analyse” and “decide” leveraging cutting-age AIoT technologies

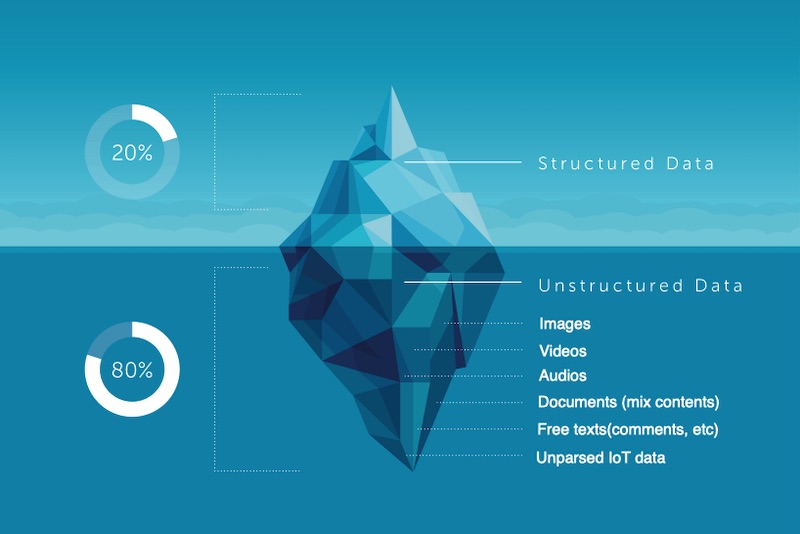

RPA 1.0 dealt with structured data that were already digitalized and structured. In Insurance sectors, key transaction data are usually saved in table format (i.e., a policy, a vehicle, a submission, a claim) and each column contains pre-defined and useful attributes of those transactions. Data in such form is commonly referred to as structured data. However, 80%+ of the stored data and the new data (i.e.. vehicle damage photos, pipe reparation invoices, or client’s description of the accidents, etc.) are in unstructured formats such as images, videos, audios, pdf documents, free texts and so on.

The capability of extracting valuable information automatically from unstructured data to is the foundation for business to implement “Intelligent” Automation, because up to now, human intervention is still unavoidable to “see” through such unstructured formats in order to obtain the “significant” data points for the decision-making, “analyse” manually the implications and then “decide” the next steps.

The present AI technologies of Computer Vision and Natural Language Processing will help to conduct such conversion. Unstructured data would be “seen” and “analysed” holistically by algorithms and interpreted for downstream logics and routings. The promisingly booming AIoT technologies should play a more and more influential role in the next-level RPA.

Insurance itself should be the initiator of redesigning the Automation-Driven systems

The Automation-Driven systems require insurers to redesign completely their current business processes. Insurers can not only rely on external IT/RPA advice since they should be the ones that know best of their own business. A surgical analysis of current business logics, understanding which ones are feasible to be automized and which one are not in the short term, is the basis for an efficient redesign.

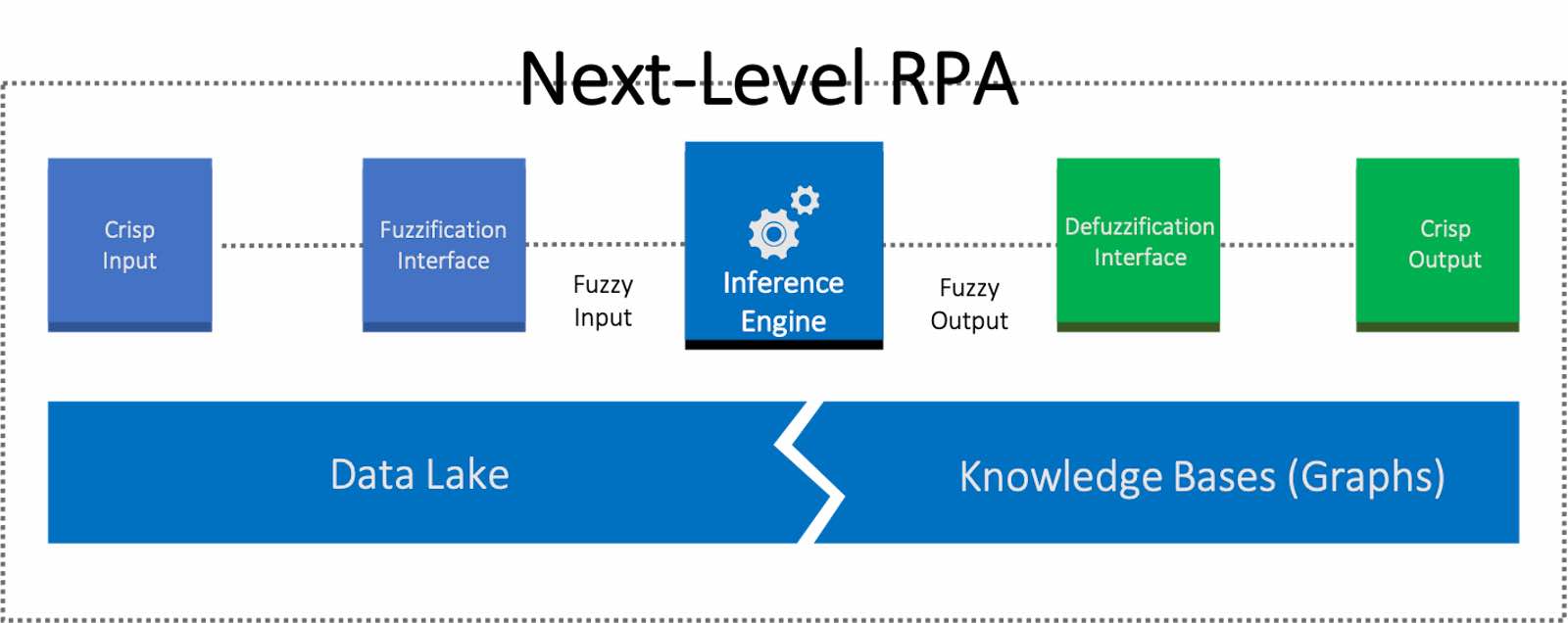

Automation maximization means possible outcomes anticipation. When the business logics are complex, it’s not possible to pre-define or maintain all nodes in the automatic workflow by human efforts. In this circumstance, technologies such as Knowledge Graph, Knowledge base and Inference Engine can be introduced on top of a 360° comprehensive data lake.

Knowledge Graph focuses on uncover the hidden connections between concepts and entities. A Knowledge Based system consists of a knowledge base representing facts about the world and ways of reasoning about those facts to deduce new facts or highlight inconsistencies. Knowledge Graph is a specification of Knowledge Base. Inference Engine applies logical rules to the knowledge base to deduce new information. The combination of these technologies can increasingly emulate human-level decision making with the additional benefits to eliminate the potential human bias, hence realize the next-level of RPA.

TECHENGINES.AI positions itself as the Automation Enabler of Insurance industry. It’s specialized in offering AIoT solutions that help to take the insurance RPA to the next level. Thanks to its deep knowledge of both the Insurance core business and extensive competency with technology, TECHENGINES.AI also supports incumbent players to understand where they stand right now in the transition and design the most effective paths towards Insurance 4.0.