The roadmap of Insurance towards Industry 4.0 is no different from the one of Manufacturing

The Industry 4.0 or Forth Industry Revolution is the ongoing Automation of traditional manufacturing and industrial practices, using modern smart technology. The term is originated in 2011 from a project in the high-tech strategy of the German government, which promotes the computerization of manufacturing. There are four principles identified as integral to Industry 4.0:

- Interconnection

- Information transparency

- Technical assistance

- Decentralized decisions

There are extensive technologies related to Industry 4.0, in which IIoT (Industrial Internet of Things) is an important component. However, as mentioned in our previous article, without combining the advanced AI technologies, most of the enormous amounts of data generated from IoT devices would be just wasted(unstored and unanalysed). Therefore, we believe that AIoT should be considered as a unique component when an industry designs its roadmap towards Industry 4.0.

Industry 4.0 is a revolution of actual organizations and value chains. It requires to reconstruct the whole ecosystem of the business to allow maximum flexibility, productivity, and profitability.

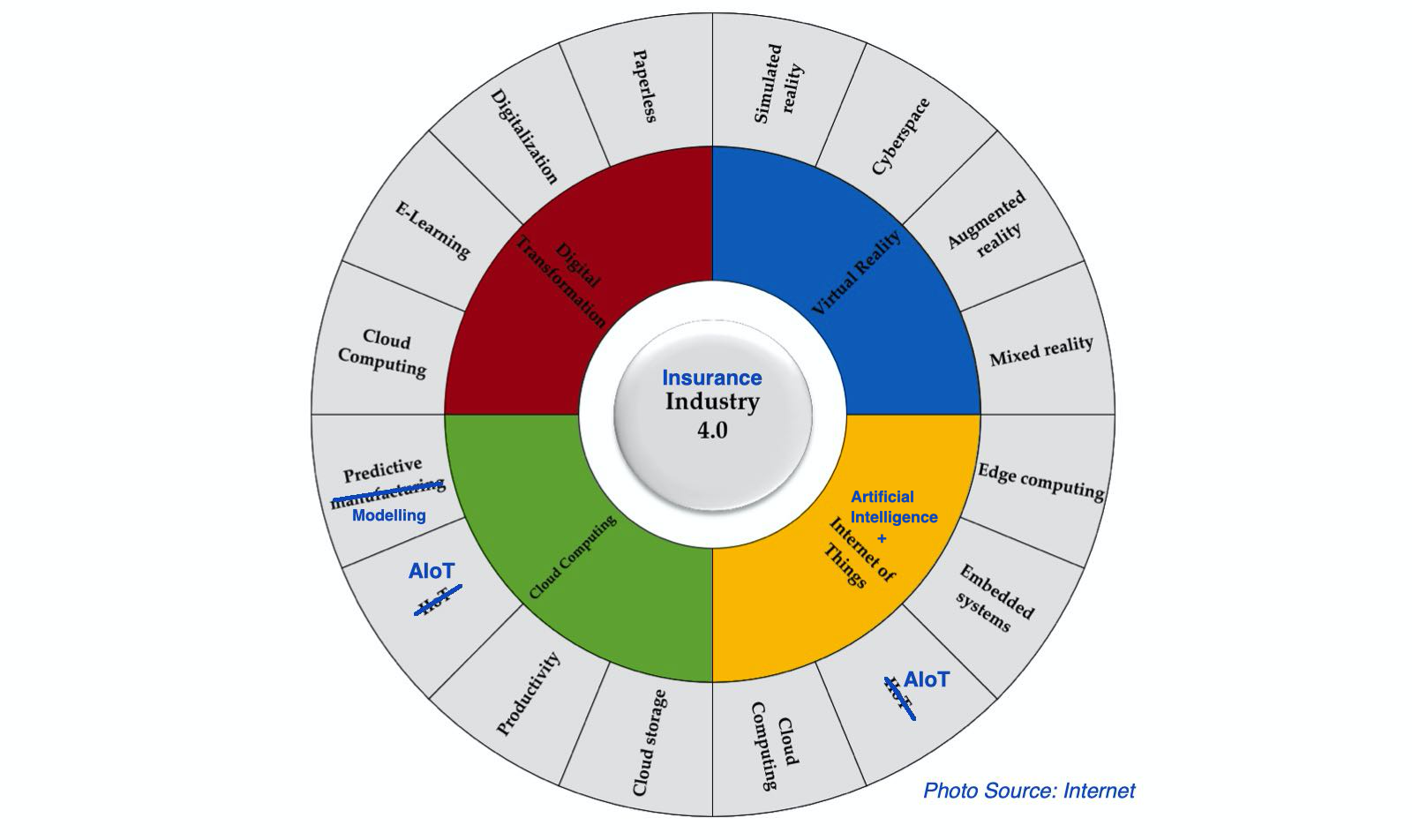

It’s obvious that all above concepts can be applied to almost every industry, including Insurance. The below I4.0 blueprint can be easily interpreted as Insurance 4.0.

Digitalization and Interconnectivity are the two key pillars of Automation

The 4 essential components to enhance the digitalization and interconnectivity hence, to enable the Automation are:

- Digital Transformation: build the data sources that acts as the ground base of the Automation

- Cloud Computing: provide the computing power that empowers the Automation

- AIoT (AI+ IoT): Combined the machine intelligence and connected things that executes the Automation

- Virtual Reality: Introduce necessary human intelligence that safeguards the Automation

The technologies in all above 4 components are well-established and have experienced a tremendous performance improvement and a drastic cost reduction. Such advancements have laid a good foundation of realizing Insurance 4.0.

Challenges often come from inside notwithstanding the available technologies

Although the roadmap towards Industry 4.0 for Insurance sound clear and promising, quite a lot challenges remain to be resolved mainly because a significant part of the Insurance industry is still striving to arrive or to consolidate their position towards Insurance 3.0.

Some evidences are:

- Product distributions remains heavily dependent to human contacts with paper product brochures.

- More than 85% of the archived data remains unstructured with the format of scanned images, free texts, etc.

- More than 50% of the current insurance systems are still legacy systems.

- Less than 50% of the current processes are digitalized even for new business.

- Only a few insurers started to invest in constructing a solid and comprehensive data lake.

- Only a few insurers are actually collecting and using IoT data.

- Only a few insurers are actively embracing the Cloud.

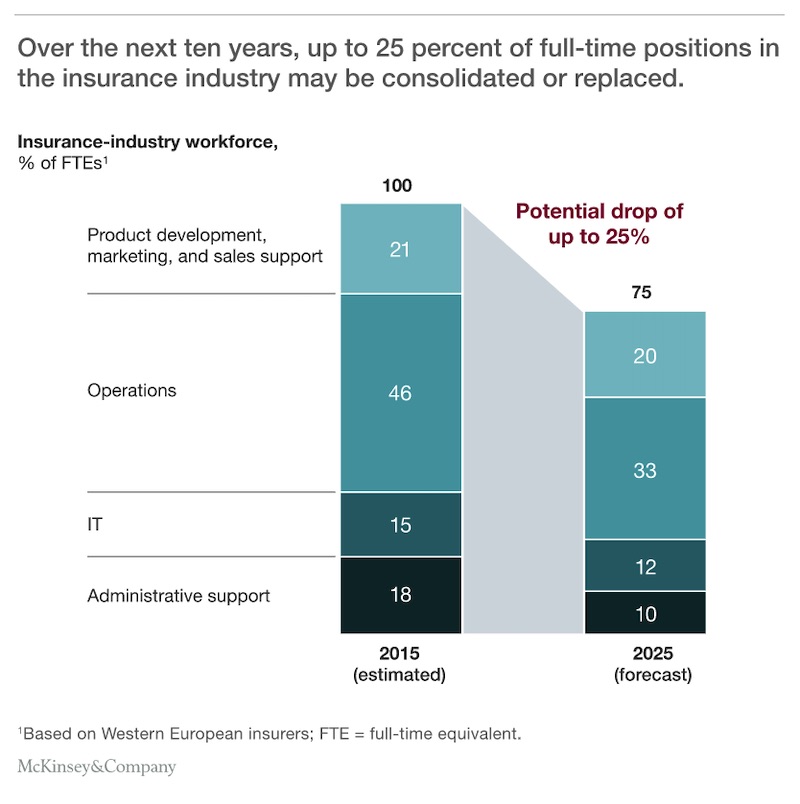

McKinsey studies estimated that the Insurance industry would have the potential to automate 25% of the process by 2025, even though the total premiums of the relatively standardized products, such as Motor | Property | Worker compensations|… count over 60% of the total P&C sectors.

There’s a huge Automation gap between Manufacturing and Insurance industries. Such gap will unavoidably tempt the new forces enter the Insurance sector, disrupt the current landscape, and pose risks to incumbent players. Tesla Insurance is just the beginning.

TECHENGINES.AI positions itself as the Enabler of the Disrupters for the Insurance industry. It’s specialized in offering AIoT solutions that interconnect and integrate with other technologies inside the Digital Transformation, Cloud Computing and Virtual Reality components. Thanks to its deep knowledge of both the Insurance core business and extensive compentency with technology, TECHENGINES.AI also supports incumbent players to understand where they stand right now in the transition and design the most effective paths towards Insurance 4.0.