AI can effectively interprete complex IoT data so to empower AIOT Insurance

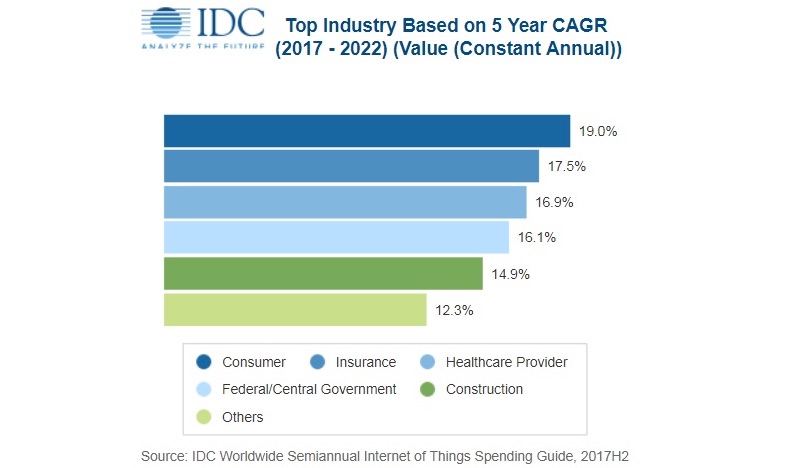

IoT (Internet of Things) has long gone beyond a buzzword and its surge is unstoppable. Every second, countless sensors are generating terabytes of real-time data points. IoT enables the network of “things” to observe, record, understand and guide situations without human presence. IoT has to affiliate with AI because only machines can tackle with such a tremendous amount of data. Many new opportunities and markets have begun to appear with the convergence of AI and IoT, according to IDC (International Data Corporation), insurance is the second industry that’s most impacted.

Insurance applies actuarial science that uses mathematical and statistical methods to analyze historical portfolio and loss data, to assess present risks and to predict the future events. In the era of big data, insurance has to take more proactive control of risk selection and risk prevention. AIoT, the combination of AI and IoT, is the ultimate key.

The power of having real-time IoT data combined with AI algorithms

Insurance is a business. An insured, pays a upfront premium to the insurer so that its/his/her loss is covered when the designated risk happens. Therefore, one of the essential skills that an insurer has to master is to predict correctly the probability of the risk occuring in the future.

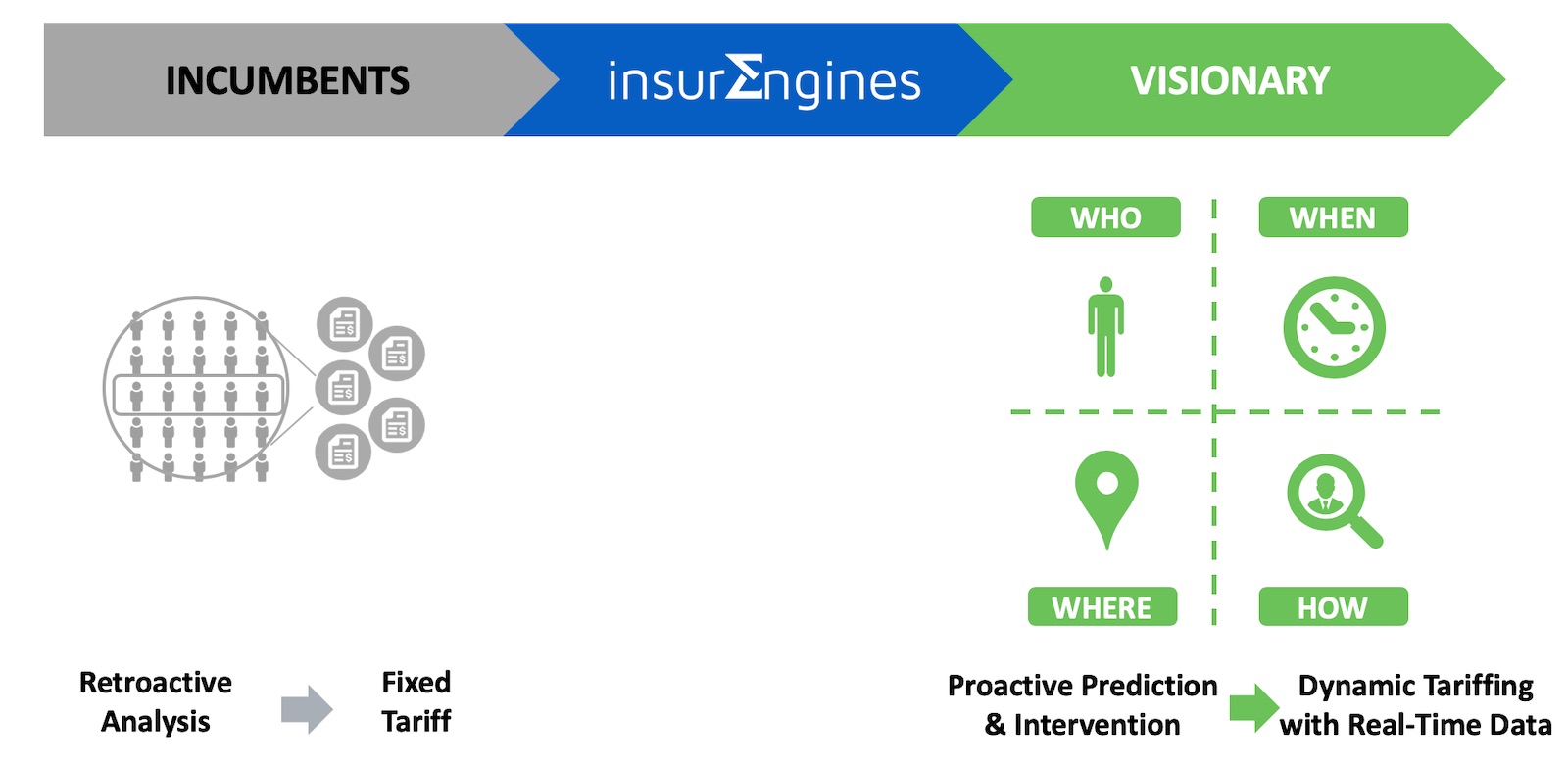

Traditional actuarial science uses retroactive deterministic models to construct a series of rate tables with fixed coefficient in order to tariff the risks and calculate premiums. The innate lag of historical loss data prohibits actuaries from adjusting promptly the risk evalution and consequently applying the correct pricing.

Real-time IoT data can fundamentally change the traditional approaches and are creating brand-new opportunities for insurers. Visionary innovators in the industry have started to apply real-time dynamic pricing and to price individual risk more precisely based on “WWWH” (Who, When, Where and How). Moreover, AI predictive algortims, which are capable of processing the IoT data in real-time manner, also allow insurers to offer advices to prevent risk incidents from happening or to provide immediate helps right after the risk incidents. AIoT insurance can tranform insurers from passive receivers to active intervenors in order to have a much better control their risk portfolios and improve their profitability.

AIoT technologies will be a disruptor to status quo

AIoT technologies will disrupt existing insurance business model. The 3 key assets of insurance business are:

- Capital

- Data

- Analytical Capabilities

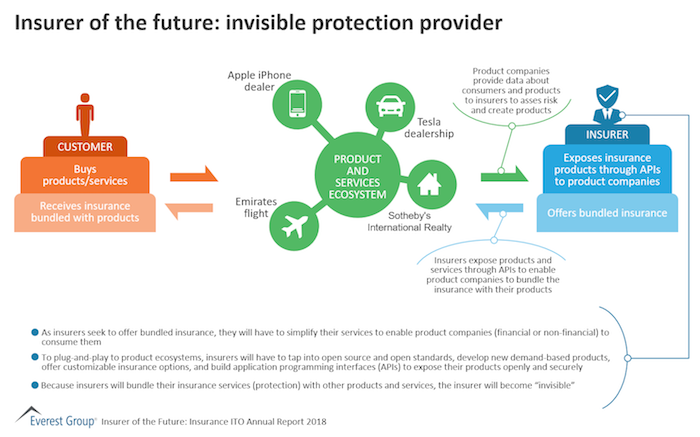

The new IoT ecosystem - made of globale players, such as device manufacturers, automotive OEMs, home security providers, Isp operators - will become the new possessors of customer interactions and invaluable behavior data. The shift of data possession will eventually entice new-entries to cross traditional industry bondaries and compete with incumbents. And modern AI algorithms have outperformed the traditional acturial algorithms such as GLM (general linear model) on predition in many circumstances.

If insurers continue to be reluctant to adopt the AIoT technologies, acting as an invisible protector behind the scene could be one of the possible scenarios for the future insurers.

AIoT Insurance is the opportunity of new growth

Like all innovations, AIoT technologies are shifting the market boundaries, but at the same time, it’s also introducing possibilities of creating new value proposition for insurance to new growth opportunities. Visionary insurers can levarage its current customer base, benefit from AIoT Insurance to offer better products/services and better engage their customers.

The earlier insurers realize these opportunities and take actions, the more successful they will be in this continuously transforming market.

Top 3 insurance product lines that are already under transformation are:

- Motor / Car Insurance

- Health Insurance

- Home Insurance

Check out TECHENGINES.AI InsurTech AI Solutions and stay tuned for our next articles on how TECHENGINES.AI can accelerate the implementation of AIoT Insurance!